As shale-led natural gas production increases in North America, companies around the world are exploring different monetization options. Producing methanol from natural gas has emerged as a popular option for several reasons. Natural gas is a cheap and abundant feedstock in North America, methanol is easy to transport, methanol has numerous uses, methanol prices tend to move with oil prices, and the market is growing globally

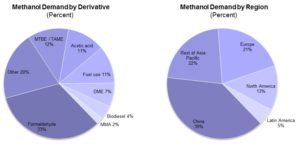

Methanol has many uses, but its largest use is as a chemical feedstock. The production of formaldehyde uses 30% of methanol production each year. About 10% of methanol is used in the production of acetic acid. Fuels account for 12% of methanol in addition to methanol use for producing MTBE, a fuel additive that helps prevent engine knocking, which is no longer used in the United States but is still used around the world. Methanol can also be converted to gasoline using the MTG process.

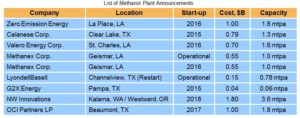

Global demand for methanol is growing at 6%-8% per year. China uses over 40% of the world’s methanol while the rest of Asia and Europe account for about 20% each. Below are graphs showing methanol demand by derivative and by region. Currently, North America is a net importer of methanol but the landscape is set to shift with new methanol plant capacity coming online in the near future. Methanol production in the United States is projected to increase four-fold from its 2014 levels by 2017. Below is a list of methanol projects that are planned to start in the United States.

However, new methanol projects are vulnerable to financing risk due to their high levels of capital expenditure. Depending on project size, capital cost of a new, world scale, methanol project can range from $1 to $2 billion dollars. Volatile commodity prices also threaten these projects as the main driver for North American methanol production is the availability of cheap natural gas. Industry leaders such as Methanex and Celanese are more likely to complete their projects due to their strong balance sheets and strong presence across the methanol value chain.

In summary, methanol is a promising natural gas monetization option. New North American projects are likely to change the United States from a net importer of methanol to a net exporter. However, these projects face risks from volatile commodity prices and high capital costs. Even so, there are several projects planned to produce methanol.

-Tyler Wilson and Uday Turaga