Thanks to shale gas, natural gas production is outpacing demand and available cheaply. As a result people are looking for new ways to use natural gas. One way is to use natural gas as a transportation fuel for heavy-duty trucks and marine ships. The main driving force behind such applications would be a price difference between natural gas and traditional fuels such as diesel to incentivize the switch.

When natural gas prices were low in comparison to oil we saw several major announcements around the use of LNG as a transportation fuel. Manufacturers of heavy-duty trucks such as Navistar, Freightliner, Peterbilt, Kenworth, and Volvo all announced that they were making LNG truck available. Cummins, one of the largest manufacturers of diesel engines in the world also announced that they would be offering LNG engines in limited quantities. Waste Management converted 40% of its fleet into CNG trucks and others such as UPS and FedEx were considering adding more LNG trucks each year.

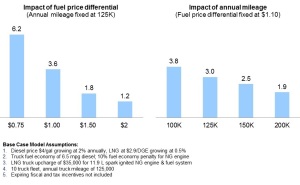

It is very costly for fleet owners to switch from diesel to natural gas and without a difference in fuel pricing it is not economically feasible to stop using diesel. ADI Analytics estimates the price difference between diesel and LNG is $0.75 per gallon it would take more than six years to see a positive return on investment. However, if the price difference is $2 per gallon, it would only take 13 months to see a return on investment. Below is a graph of estimated payback periods for LNG trucks.

If price differential is the main driver to incentivize the switch from diesel to natural gas in the trucking industry, environmental regulations could possibly be a bigger driver for the marine industry. Natural gas burns cleaner than both diesel and heavy fuel oil, which are commonly used today in marine vessels. Emissions Control Areas cover the Gulf, Pacific, Atlantic, and Hawaiian coasts in the United States are under tighter marine fleet emission regulations than the rest of the ocean. If these regulations were to be enforced more heavily, or were to become more expansive, the need for cleaner burning LNG ships would be more easily justified. Today, ships must rely on scrubbers in order to meet regulations. Long term, a fleet owner could invest in LNG ships in order to avoid the use of scrubbers. Also, it is also possible that diesel or heavy fuel oil fueled ships with scrubbers could still fail to meet new ECA regulations, driving demand for LNG ships.

In summary, if the price difference between diesel and natural gas is as low as it currently is, it is less likely that it will be economically feasible for fleet owners to make the switch to natural gas. However, if regulations surrounding emissions for marine ships continue to tighten, then fleet owners will seriously consider LNG to fuel their ships.

-Tyler Wilson and Uday Turaga