Floating liquid natural gas (FLNG) is a new technology pioneered by Shell, but companies are already trying different approaches to improve its cost effectiveness and speed of construction. As a first mover in this space, Shell is using its scale and traditional leadership in oil and gas technology to its advantage. Golar is using its existing fleet as a way to quickly convert a transportation ship into an FLNG vessel, while Excelerate and Cambridge are trying to utilize onshore feedstock infrastructure access to bring LNG to market quickly.

Shell pioneered FLNG technology and is commercializing it through the Prelude project on which the final investment decision was taken in May 2011. Shell plans to have Prelude operating off of the northwest coast of Australia by 2016. This 488-meter ship is the largest floating vessel ever constructed and is planned to have a capacity of 5.3 mtpa of liquids, 3.6 of which is set to be LNG. All at a cost of $10.8 to $12.6 billion dollars.

In addition to Shell, a couple of smaller companies are also working on FLNG but are trying to further improve its cost effectiveness. For example, Golar LNG of Norway, an established player in the transportation, storage and regasification of LNG, is planning to revamp one of its older LNG ships into an FLNG platform. This is anticipated to be a faster way of getting into the LNG market in comparison to building brand new ships or onshore LNG trains. The Golar vessel has a planned production capacity of 2.3 to 2.8 mtpa of LNG, along with 125,000 cubic meters of LNG storage capabilities and is planned to be deployed by early 2017 at a to-be-determined location.

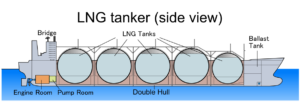

A typical LNG transport ship similar to what Golar is revamping into an FLNG vessel, photo only courtesy of Wikipedia

Further, eight of the over thirty LNG projects in the United States that have applied for U.S. Department of Energy approval for export to non-free trade agreement nations are planning on using FLNG technology. These include Cambridge and Excelerate which are planning projects sized at 8 and 10 mtpa, respectively in the U.S. Gulf Coast. Although, neither project has received U.S. Department of Energy approval for export to non-free trade agreement nations both are planning to start production by 2019. Both of these projects are close to shore and aim to leverage existing natural gas pipeline infrastructure to supply feed gas in the hopes that it will further improve their projects’ cost effectiveness relative to both onshore terminals as well as other FLNG projects.

Floating LNG offers the promise of several benefits over onshore LNG trains. One of the major benefits is that the vessels can be constructed quickly and cheaply and the trains can start producing LNG faster than onshore plants. If the new FLNG projects are successful in further improving cost effectiveness, LNG supply will become more competitive and affordable.

-Tyler Wilson and Uday Turaga