United States natural gas production has grown at a rate of 3.8% per year since 2008 from 55 Bcf/d to 66 Bcf/d in 2013. Shale gas production, however, has grown at a much faster pace. In 2008 production was less than 6 Bcf/d, but production grew at a rate of over 40% per year to more than 30 Bcf/d in 2013. This rapid growth may be stunted by the recent decline in both the price of oil and natural gas, making some wells not as profitable as they would have been at higher price levels and also causing some wells to never be drilled to begin with.

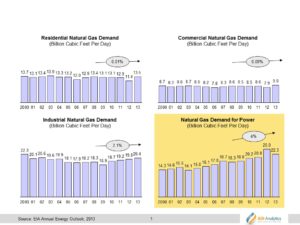

Although natural gas production in the United States has grown since 2008, when the American shale boom started, demand for natural gas in the United States has not quite kept pace. Over the same period from 2008 to 2013 demand grew at a rate of 2.1% per year. Most of the demand for natural gas comes from four segments: residential, commercial, industrial and power generation. Residential is defined as use in private dwellings, commercial is defined as use in non-manufacturing establishments and industrial is defined as use by manufacturing, agricultural or chemical industry for both power, heat and feedstock. The figure below shows how demand for all but the power generation segment has decreased overall since 2000 but also shows an increase in the last five years. The increase in natural gas demand for power is being driven mainly by the retirement of older coal-fired power plants and their replacement with new natural gas-fired power plants.

Of the four major gas demand segments, three of the four, residential, commercial and industrial are grew at 0.1%, 0.9% and 2.1% from 2008 to 2013, respectively. Looking into the future, it is expected that the industrial demand for natural gas will grow faster than for residential and commercial segments due to investments in new chemical, steel, and other manufacturing plants all of which use natural gas as a fuel or feedstock for their operations. Although demand for natural gas in the industrial space is expected to rise, the new projects that are driving this demand are going to be much more energy efficient than their predecessors.

For example, Dow Chemical Company claims to have reduced their energy consumption by 38% and has plans to further increase their energy efficiency. The chemical industry as a whole has also been becoming more efficient with in regards to energy use. According to the International Council of Chemical Associations, producers in the United States are now twice as energy efficient as they were in 1974 at producing chemicals.

The fastest growing segment of natural gas demand is power generation which, from 2008 to 2013, grew at a rate of 4% annually. Since 2009 there has been a shift from coal-fired power plants to gas-fired plants. In 2009, coal-fired and natural gas-fired plants accounted for 44% and 23% of electricity generation, respectively. In 2013, coal and gas-fired plants accounted for 39% and 27% of electricity generation. As the fleet of coal-fired power plants grows older and new regulations including the Clean Power Plan proposed by the U.S. Environmental Protection Agency, the outlook for further expansion of natural gas-fired power generation capacity looks promising.

In summary, natural gas demand is being driven by power generation, and although other segments are growing, they are unlikely to increase total demand to absorb the dramatic growth in North American natural gas supply. Even industrial demand for natural gas will be insufficient to grow total natural gas demand substantially because the new manufacturing plants proposed are going to be far more energy efficient than existing capacity, as discussed earlier. Therefore, North American natural gas will continue to be oversupplied and LNG exports offer the best gas monetization option assuming that the upcoming terminals can be competitive at low oil prices as well.

-Tyler Wilson and Uday Turaga